The advertising industry must focus on Return on Investment (ROI) to ensure every rupee spent on advertising is considered an investment

While officially our advertising industry expenditure (adex) is at a paltry $7 billion, the brands we build and help sell together account for a few hundred billion dollars, annually. Without brand building, we would be selling products, sometimes at half the price of the reigning consumer price (Apple’s gross profit margin: 45 per cent). Take any big brand, say Orange that became Hutch and then Vodafone. Their cumulative adex over last 15 years could be $320 million but today Vodafone India is a formidable brand clocking $7 billion in annual revenues. This inequity is a global practice though.

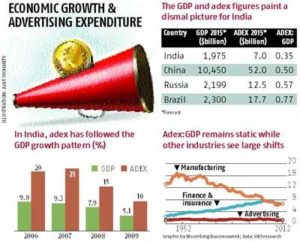

The GDP and adex figures, paint a dismal picture for India. Despite a robust talent pool and an independent/thriving ad industry; our ‘adex: GDP’ versus other BRIC countries is quite low. In India, adex has followed the GDP growth pattern as is evident in the chart. Despite the growth, adex:GDP has stayed flat. The economy has its cycles but advertising has bucked the swings – and that meant, adex:GDP has remained static over time. While other components of company spending – such as human resources, working capital, information technology – have fluctuated, ad spending has not. It seems advertisers have failed to convince the client community of the value of advertising as an investment.

A study by Richard van der Wurff, Piet Bakker and Robert G Picard (Journal of Media Economics, 2008) of adex and GDP for 21 industrialised countries across 14 years (including years of economic upturn and downturn) provides a few interesting findings:

> Advertising expenditures have a natural tendency to be larger in larger economies i.e. adex share of GDP tends to be higher when GDP is bigger.

> Structural composition of the economy is a factor that co-determines how large a percentage of GDP is spent on advertising expenditures (Picard 2001). For example, a higher share of manufacturing can lead to higher adex as GDP percentage.

> Multiple studies support the finding that newspapers, magazines, and outdoor advertising respond differently to economic change than advertising in TV, Radio, and Cinemas. The former respond relatively strongly to macroeconomic development – shrinking during downturns and growing when the economy grows – while the latter appear relatively immune to economic change.

> Responsiveness to economic change: Countries where newspapers have a larger share in total advertising expenditures show strong adex response to economic changes than countries where newspapers are less important as advertising medium. Another factor influencing the responsiveness of advertising to GDP is the advertising intensity.

This last point is a favorable pointer to growth in India’s adex. We continue to depend heavily on newspapers (36 per cent) and strong economic growth predictions in 2015 and beyond should help push newspapers (9 per cent YoY growth) and adex up.

This last point is a favorable pointer to growth in India’s adex. We continue to depend heavily on newspapers (36 per cent) and strong economic growth predictions in 2015 and beyond should help push newspapers (9 per cent YoY growth) and adex up.

> Fueling growth: Does all the above mean we have no choice but to wait for the economy to grow before we see growth in adex? While the biggest push will always come with GDP growth, growth of any industry is typically propelled by a few factors:

* Market forces: Greater competition/ lower monopolies will ensure a better market place. The recent entrepreneurial spirit among Indian advertising folk is will help expand the overall market.

* Transparency: Ethical business practices help reduce risk and uncertainty, thus, reducing cost of capital. Statistical work has supported the theory: All things being equal, more transparent firms perform better than less transparent firms’ (Source: Transparency and Governance in a Global World by J Jay Choi, Heibatollah Sami, Suk-Joong Kim, Michael McKenzie).

* Accountability: Advertising has often been an ‘investment before the actual returns’ and first time advertisers have had the greatest trepidation before taking the plunge. Greater accountability of the marketing rupee helps build an ecosystem of confidence. Often this is more anecdotal than data/ analysis driven. Entrepreneurs bet heavily on such feel good factors when taking the final plunge on advertising investments.

Marketing analytics has been a great aid to building accountability. However, data (rather, the lack of it), talent and cost have deterred marketers from building case studies. Our industry must focus much more on return on investment to ensure every rupee of advertising expenditure is considered an investment.

* Government support: The IT Sector has been a huge beneficiary of government support over the last three decades. Of several studies dedicated to understanding the role of government and policy interventions in building the $100 billion success story, I quote Sonia N Aggarwal (Berkeley APEC Study Center, June 2013):

a. The state has played a major role in two areas. First, help raise start-up capital . Second, it has addressed protectionist policy failures, but slowly enough to give Indian firms enough time to adjust without falling prey to clientelism. The government’s greatest contribution to the software industry is arguably its development of human capital. Not only did the Indian government create the means of a highly trained workforce, but it also created opportunities for this workforce through the creation of software technology parks and infrastructure development, specifically targeted to the industry. The ability of the state to identify weaknesses in the market and address them has led to the Indian software facing very little stagnation despite changes in the market conditions.

b. Through creating a systematic method of reducing protectionist policies while bolstering Indian firms by sponsoring education and infrastructure growth, the Indian government has created an effective model for state action. As Indian software firms continue to move up the value chain, additional government policies may also become necessary, particularly to address new challenges.

* Quality of manpower, quality of output

a. Tap the best talent.

b. Our work must be the biggest ambassador with clients and peers.

All is not lost if we appreciate the contribution the advertising and media industry make to our economy and provide a better talent pool, higher government support, bigger turnover, better margins and better capitalizations.

(This article first appeared in The Business Standard)